Japan Real Estate Asset Management is an asset management company of Japan Real Estate Investment Corporation, the first publicly listed J-REIT in Japan.

Japan Real Estate Asset Management Co.,Ltd.

Japan Real Estate Asset Management is an asset management company of Japan Real Estate Investment Corporation, the first publicly listed J-REIT in Japan.

Japan Real Estate Asset Management Co.,Ltd.

| Corporate Name | Japan Real Estate Asset Management Co., Ltd. |

|---|---|

| Address | OTEMACHI Park Building 1-1-1 Otemachi, Chiyoda-ku, Tokyo 100-0004, Japan Google Map |

| Date of Establishment | October 1, 2000 |

| Capital | ¥263,197,000 |

| Shareholders | Mitsubishi Estate Co., Ltd. 100% |

| Business Lines | Investment management business (Financial Instrument Business Operator, Director of the Kanto Local Finance Bureau (Kinsho) No. 335 and Member of The Investment Trusts Association, Japan) |

| Number of Employees | 53 (excluding part-time directors) |

| Directors | President & CEO Shojiro Kojima Director Miwako Chiba Director Yoshinori Kurokawa Director (part-time) Takahiro Ishii Auditor (part-time) Takuro Yamanaka |

| Licenses, etc. | Financial Instruments Business Operator Registration Registration Number : Director of Kanto Local Finance Bureau (Kinsho) No. 335 Building Lots and Building Transaction License License Number : Governor of Tokyo (5) No. 78927 Building Lots and Building Transaction Agency Permit Permit Number : Minister of Land, Infrastructure, Transport and Tourism No. 1 |

| Memberships | The Investment Trusts Association, Japan The Association for Real Estate Securitization |

| January 11, 1972 | Established Ryochi Real Estate Co., Ltd . |

|---|---|

| September 8, 2000 | Obtained Building Lots and Building Transaction License |

| October 1, 2000 | Changed its trade name to Japan Real Estate Asset Management Co., Ltd. Changed business line to investment corporation asset management business under Article 2-17 of the former Act on Investment Trusts and Investment Corporations prior to the revised Act on Investment Trusts and Investment Corporations enacted on September 30, 2007 |

| December 19, 2000 | Obtained Building Lots and Building Transaction Agency Permit |

| March 7, 2001 | Obtained business permit as investment trust management business under the former Investment Trust Act |

| May 18, 2001 | Concluded investment management agreement with Japan Real Estate Investment Corporation |

| September 30, 2007 | Registered as investment management business |

Japan Real Estate Asset Management (“JRE-AM”) is a J-REIT asset management company with Mitsubishi Estate Co., Ltd. as its 100% shareholder. JRE-AM provides asset management services for Japan Real Estate Investment Corporation (“JRE”), the first J-REIT in Japan listed on the Tokyo Stock Exchange in September 2001. Specializing in office buildings in Japan, JRE’s asset size now exceeds 1 trillion yen. JRE offers investment opportunities to its excellent and diversified office portfolio for a wide range of investors.

Our steady asset management track record and comprehensive information disclosure has been well received by the market since our establishment. The broad range of expertise and human resource support we receive from the Mitsubishi Estate Group, one of Japan’s leading comprehensive real estate corporate groups, serves as a major strength. Meanwhile, we have seen changes in the office market and in people’s workstyles in recent years due to the aging and shrinking population, rapid progress in information technologies, and the global pandemic of COVID-19. We will endeavor to carry out proactive asset management that stays ahead of the times by anticipating such changes in the business environment.

We have also positioned environmental, social, and governance (ESG) initiatives as one of our most important management priorities. We have stated our understanding of the issues we face and our policies in response to them as a management company in our Sustainability Policy. JRE’s website also discloses detailed information on its ESG initiatives, including the target of reducing CO2 emissions by 2030.

Our mission is to contribute to society in Japan by providing high-quality office space while maximizing long-term returns for unitholders by offering long-term investment opportunities. To realize this mission, we must gain the cooperation of various parties, including tenants, those engaged in the operation and management of properties, those responsible for the supply chain, and local communities. We are committed to collaborating with all such stakeholders while further deepening communication with them. Your continued support will be greatly appreciated.

Shojiro Kojima

President & CEO

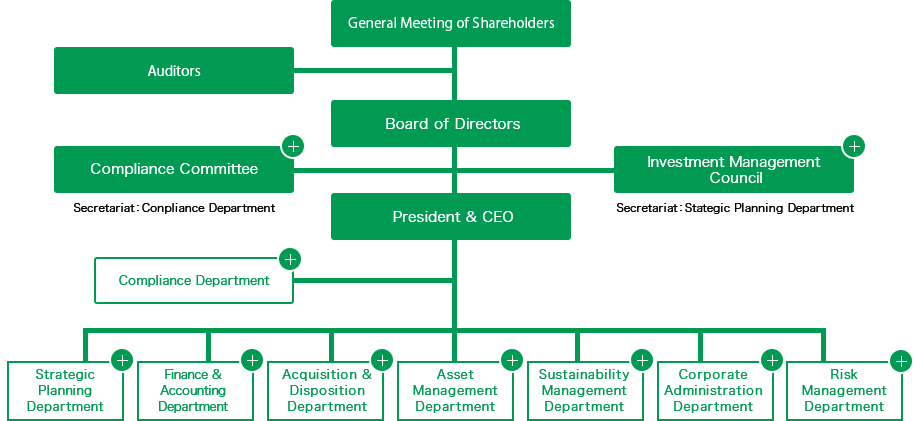

The Compliance Committee deliberates on and determines development of the compliance system for JREA and other material compliance-related matters. The committee is also charged with preventing business transactions between Japan Real Estate Investment Corporation and key related parties from causing harm to the interests of the Investment Corporation.

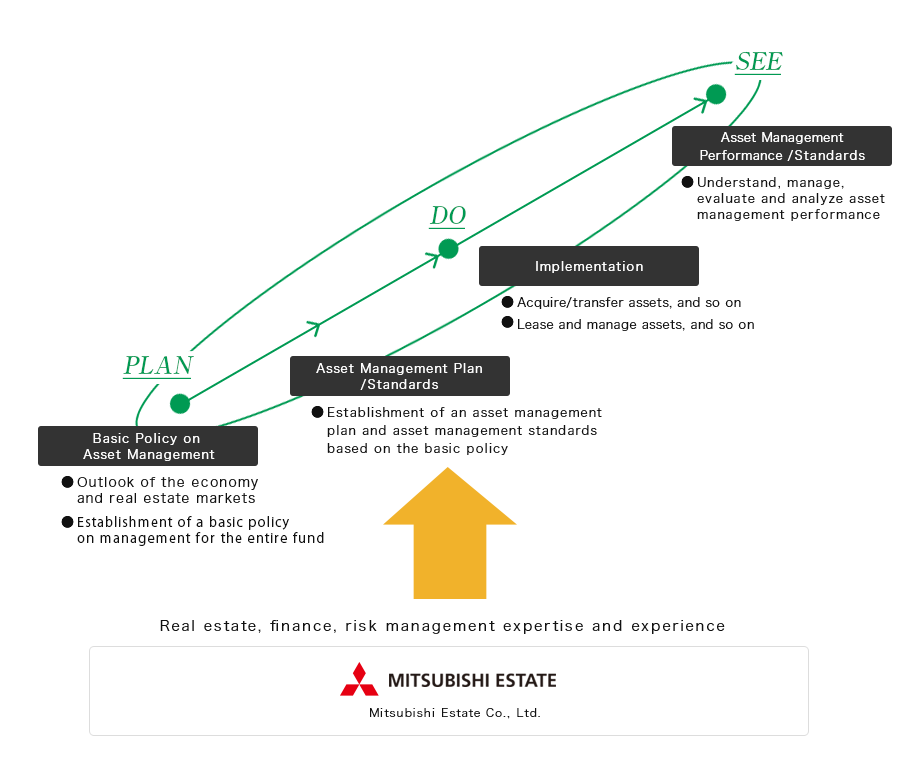

The Investment Management Council deliberates on the Investment Corporation's asset management plan, medium- to long-term management policy, asset management plan, standards of asset management and investment management and other important decisions and investments. Following this, approvals or resolutions are made based on discussions at JREA's Board of Directors and the Investment Corporation's Board of Directors.

The Compliance Committee deliberates on and determines development of the compliance system for JREA and other material compliance-related matters. The committee is also charged with preventing business transactions between Japan Real Estate Investment Corporation and key related parties from causing harm to the interests of the Investment Corporation.

The Investment Management Council deliberates on the Investment Corporation's asset management plan, medium- to long-term management policy, asset management plan, standards of asset management and investment management and other important decisions and investments. Following this, approvals or resolutions are made based on discussions at JREA's Board of Directors and the Investment Corporation's Board of Directors.

Our business activities originate in the trust placed in us by investors.